The Future of Payment in Energy Retail

By Cheryl Ashton, Marketing Coordinator, TSG UK

The way customers pay for fuel and convenience goods is changing. Once dominated by cash and chip-and-pin, the forecourt has become a proving ground for payment innovation. Today, mobile wallets, contactless cards and self-service kiosks are commonplace. Tomorrow, biometric authentication and blockchain may redefine the very nature of trust in retail transactions.

This article examines the evolution of payment technology in energy retail, the growing demand for speed and security, and the role of integrated systems in shaping the consumer experience. It also highlights how TSG UK is helping forecourt operators navigate this transformation with confidence.

The Decline of Cash and the Rise of Digital

Not long ago, the idea of a cashless forecourt seemed far-fetched. Yet, the shift away from physical currency has been swift and decisive. Contactless cards, once met with scepticism, are now the preferred method of payment for many. The rise of mobile-first lifestyles, combined with the widespread adoption of digital wallets and tap-to-pay technology, has made fast and frictionless transactions the new norm.

Digital wallets like Apple Pay, Google Pay and PayPal have made the process even easier. Mobile wallets rely on near-field communication (NFC) and tokenisation to ensure each transaction is fast, secure and protected from fraud. Tokenisation swaps sensitive card details with a unique code, making it harder for hackers to steal or misuse information.

For forecourt retailers, this shift presents both challenges and opportunities. Customers expect fast, frictionless payments, whether they are buying fuel, coffee or groceries. Retailers must respond with systems that are not only secure but also intuitive and adaptable.

The New Standard: Seamless Integration

Modern forecourts are no longer just places to refuel. They are retail hubs offering food, drink, leisure and lifestyle services. To meet these evolving expectations, payment systems must integrate seamlessly with all on-site equipment, including dispensers, car washes, closed-circuit television (CCTV), tank-level gauges, price signs and back-office software.

TSG UK’s Prizma electronic point-of-sale (EPOS) system exemplifies this approach. It connects indoor and outdoor payment terminals, fuel dispensers and forecourt equipment into one unified platform. Its intuitive touchscreen interface simplifies transactions, while built-in tools support promotions, loyalty schemes and real-time reporting.

Security is not an afterthought in Prizma’s design; it is a core feature. The system exceeds Payment Card Industry Data Security Standard (PCI DSS) requirements, encrypts customer data using a virtual private network (VPN), and stores no sensitive card information. Forecourt operators can configure user permissions with unique identifiers and complex passwords, ensuring every action is traceable and accountable.

When paired with the Online Authorisation and Switching Environment (OASE), Prizma offers even greater protection. OASE uses a triple data encryption algorithm with a unique key per transaction, ensuring that all payments are processed securely. It also includes fraud detection features such as velocity controls and stop/allow lists, giving retailers greater control over their payment environment.

Outdoor Payment Terminals: Convenience Without Compromise

Outdoor payment terminals (OPTs) are becoming essential for busy or unmanned forecourts. These unattended systems allow customers to pay for fuel and car washes without entering the store, reducing queues and extending operating hours.

TSG UK’s Crypto VGA™ OPT is one of the most advanced solutions available. Its full-colour touchscreen guides users through transactions with clear graphics and icons. It supports multiple payment methods, including contactless, radio frequency identification (RFID) and smartphone apps, and offers additional services such as mobile top-ups and e-vouchers.

Security features include anti-tamper and anti-skimming devices, a privacy shield and compliance with the latest PCI standards. The terminal supports 17 languages, making it accessible to a diverse customer base. An optional barcode reader enables promotional campaigns and voucher redemption, turning the payment terminal into a marketing tool.

For retailers seeking a dispenser-integrated solution, the Tokheim Crypto VGA™ DIT offers the same functionality in a compact format. It integrates with leading dispenser brands and includes anti-fraud protection housing.

Self-Service and the Rise of Automation

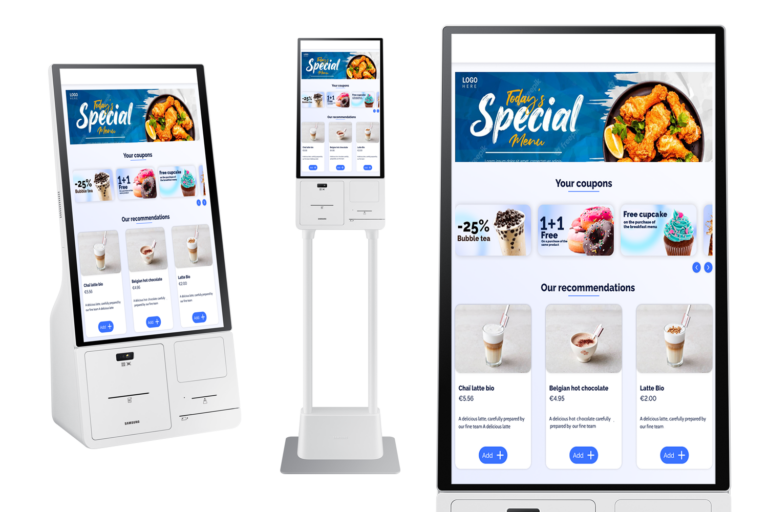

Self-checkout kiosks are transforming the in-store experience. Customers can pay for fuel, groceries and car washes in one transaction, avoiding queues and reducing wait times. They are particularly well-suited to smaller operations, where space is limited and staffing resources are stretched.

TSG’s self-checkout solution is a plug-and-play extension of the Prizma system. It features a modern interface, supports loyalty programmes and promotions, and allows one employee to supervise multiple terminals. This not only improves efficiency but also enhances customer satisfaction.

The DFS Order Kiosk adds another layer of convenience, allowing staff to focus on customer service, stock management or other core responsibilities. Its customisable layout and intuitive design make it a valuable addition to any forecourt store.

CoffeePay and CoffeePay Pro offer automated coffee vending with integrated payment options. Customers can pay using contactless methods or cash, and purchase add-ons such as biscuits or water. These systems reduce staffing needs while maintaining a high-quality customer experience.

EV Charging: A New Frontier for Payments

As electric vehicles become more common, forecourts must adapt. Payment systems for EV charging must be fast, transparent and compatible with a wide range of devices.

ChargePay, available from TSG UK, is a modern payment terminal designed for public charging stations. It accepts debit and credit cards, fuel cards and mobile payments, and provides a clear breakdown of costs covering energy, parking and transaction fees. Customers can track their sessions remotely via QR code and receive digital receipts, reducing paper waste.

ChargePay Lite and ChargePay CIT offer similar functionality with added flexibility. CIT allows users to stop charging sessions via their car, terminal or mobile device, and supports discount vouchers for nearby services. These systems integrate with all charging stations and provide centralised management via a dedicated portal.

Digital Receipts and Sustainability

One of the most popular recent innovations is the digital receipt. Delivered via QR code, these receipts offer a faster, more efficient alternative to paper. They reduce waste, support sustainability and align with consumer expectations for eco-friendly practices.

TSG’s Digital Receipt Server operates across Prizma, Crypto VGA™, self-checkout and integrated dispenser terminals. It simplifies the transaction process and reinforces the retailer’s commitment to responsible business.

Cybersecurity: Protecting Trust

In an age of increasing cyber threats, data security is paramount. A single breach can damage a retailer’s reputation and erode customer trust. Compliance with PCI DSS is not optional: it is essential.

TSG UK helps retailers upgrade their payment equipment with minimal disruption. Its systems are designed to protect customer data, maintain business continuity and ensure compliance. Remote access is restricted to authorised technicians, and servers are housed in secure, access-controlled environments.

Retailers must take a proactive stance. With over 30 years of experience, TSG UK offers expert guidance, reliable products and ongoing support. Whether it’s Prizma, OASE, Orion or ChargePay, TSG provides the tools needed to stay ahead of the curve.

Conclusion: The Future Is Smart

The future of payment in energy retail is secure, seamless and smart. Customers expect speed, convenience and trust. Retailers must respond with integrated systems that simplify operations, protect data and enhance the customer journey.

TSG UK is leading the way, helping forecourt operators embrace innovation and build loyalty in a competitive market. From mobile wallets and biometric authentication to self-service kiosks and EV charging terminals, the payment landscape is evolving. Those who adapt will thrive.