TSG’s Chairman and CEO, Jean-Marc Bianchi, was interviewed by Houda El Boudrari for the French magazine NextStep. Read the full interview translated to English below:

In an LBO with HLD for the past three years, the spin-off from service station equipment supplier Tokheim has just passed the symbolic €1 billion mark in sales thanks to a shift in its core business towards low-carbon mobility, coupled with an acquisitions policy that has boosted its growth to over 35% this year.

TSG IS ONE OF THOSE DISCREET mid-cap companies that are champions in their niche sector but unknown to the general public. It has to be said that its BtoB activity, historically linked to the relatively unglamorous fossil fuel sector, does not necessarily make it a media darling. However, the recent history of this former services division of the inventor of Tokheim petrol pumps is a textbook example of a radical pivot towards the energy transition, driven by the determination of its management and accelerated by its majority shareholder HLD since its LBO in 2020. “Fuel-related activities now account for less than 40% of the Group’s sales, constituting a smaller share for the first time than activities dedicated to low-carbon forms of energy and services for mobility hubs,” says a delighted Jean-Marc Bianchi, TSG’s Chairman and CEO. He took over the helm of the company in 2019, when fossil fuels still accounted for three-quarters of the Group’s revenues.

From split to LBO

To see just how far the company has come, we need to go back to 2016, when it was still the services division of Tokheim, formerly part of Motion Equity Partners. It split from Tokheim when the fuel pump manufacturer was acquired by the American company Dover Corporation. This was an opportunity for the management of this services subsidiary to take control of its destiny under the leadership of Baudouin de la Tour, its CEO from 2016 to 2020, with sales in the region of €550m at the time. The desire to shift the focus of this spin-off, now renamed TSG Group, towards mobility and renewable energy took concrete shape in 2019 with the recruitment of Jean-Marc Bianchi.

He had previously been the CEO of aluminous cement manufacturer Kerneos, where he led the transformation of this former Lafarge division, which was sold to Materis in an initial LBO with Wendel in 2008, then split off in a second carve-out coupled with a second LBO with Astorg in 2014, until its successful sale to Imerys in 2016. Jean-Marc Bianchi, who is probably more at home in fast-changing environments and private equity governance, left the listed group in 2019 to take up the challenge of transforming TSG. All that remained was to find a financial partner with solid backing, deep pockets and an industrial vision compatible with this new strategic direction. The search was launched in 2019 and reached its conclusion in the middle of the Covid pandemic in June 2020 with the engagement of the evergreen investment company HLD, co-founded by former Wendel executive Jean-Bernard Lafonta. HLD took a majority stake, valuing TSG at some €500m, or nearly nine times its EBITDA.

“HLD’s entrepreneurial and agile DNA was a decisive factor in our choice, as was the fact that its time horizon is not restricted by the limited duration of the investment vehicles employed by the usual LBO players,” says Jean-Marc Bianchi, who had already worked with his new shareholder during the Wendel/Materis era. The LBO, financed by €280m of unitranche debt provided by ICG, gives TSG a free hand to accelerate its strategy of diversification through acquisitions and internal recruitment.

Aiming for the future without abandoning the past

With sales of €650m in 2020, the mid-cap company claims to be the continental leader in its market, with a direct presence in a dozen European countries (UK, Spain, Central Europe, etc.), where it supplies, installs and maintains all the equipment needed to run a service station — from petrol pumps to payment terminals and car-washing equipment. Its customers include petrol station operators and mass retailers, as well as hauliers and online retailers with their own delivery fleets. The challenge is therefore to conquer the market for new sources of energy — gas, hydrogen and above all electric power — which is set to grow exponentially, without impeding the endogenous growth of the traditional fossil fuel market, which will not disappear overnight either.

At the same time, TSG is strengthening its position in services, to become a ‘one-stop-shop’ for technical solutions for its customers. It’s a vast programme that TSG has pursued with vigour, pulling several levers: “We’ve gone from 3% of sales in new sources of energy in 2019 to 30% today, and from 3,500 employees to 6,000. And we’ve just signed our twentieth acquisition in two-and-a-half years,” Jean-Marc Bianchi sums up. “The challenge is to get all the Group’s employees on board with this transition, without the traditional technicians feeling relegated to outmoded jobs,” continues TSG’s CEO. He is taking care to reassure his troops about the future of their jobs, while at the same time preparing them for the inevitable move towards cleaner energy, by providing training and recruiting new blood for the Group’s new activities. “In 2040, 60% of vehicles will still be combustion-powered,” points out the head of TSG, who predicts that the fossil fuel business will fall in relative terms to 30% of the Group’s total sales, but increase in absolute terms.

35% growth

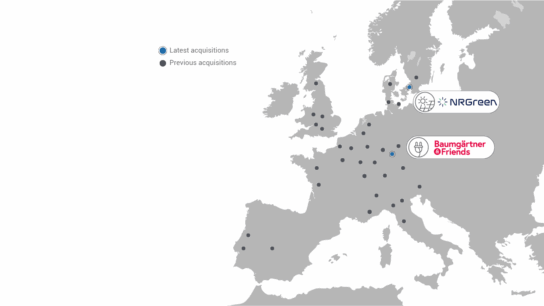

Acquisitions have also been carefully prepared to ensure that two very different cultures can be successfully grafted together. Jean-Marc Bianchi explains: “We have sifted through more than 350 potential targets for around twenty acquisitions. We pay particular attention to ensuring that the directors of the acquired companies are committed to the Group’s business strategy.” In fact, 19 of the 20 directors have joined the TSG teams. The latest acquisition this summer was JCM Solar, a company based near Angers and specialising in the design, installation and maintenance of photovoltaic power plant projects for professionals, announced at the same time as that of EEG, based in Johannesburg, South Africa, and also specialising in solar energy.

The previous 18 deals, including eight acquisitions in 2023 (Werner Stuhr, Nordic Gas, RbC Lambert, Vebe, Hemag, UCP Choix, GTC Technics and Ranzato Impiati), have strengthened the Group’s presence in strategic countries such as Germany, Belgium, Spain, the Netherlands, the UK, Italy and Sweden. The CEO, who is already well-versed in external growth operations from his time at Kerneos, has strengthened his M&A department with the recruitment of two specialists, and enjoys the support of the investment bank Financière de Courcelles as part of its multi-buy-side offer to identify European targets at an early stage.

Over the past year, the TSG Group has also continued to develop its natural gas and hydrogen segments, which grew by 46%, including organic growth of almost 27%. This will allow it to support its customers in their transition to the full spectrum of energy sources for mobility. Lastly, in July the mid-cap company announced that it had passed the symbolic €1 billion sales threshold, which signifies growth of more than 35% compared with the €730m recorded for 2022, and more than 50% since its 2020 LBO. TSG is ahead of schedule on the roadmap it has drawn up with HLD, and has no intention of slowing down. “Our aim is to exceed €1.5bn in sales in five years’ time, by continuing to generate organic growth of over 10% and maintaining our pace of acquisitions at between five and eight targets a year,” concludes Jean-Marc Bianchi.